Deposit Insurance Coverage for Ontario Credit Unions and Caisses Populaires

Financial Services Regulatory Authority of Ontario’s (FSRA) deposit insurance program protects insurable deposits held with Ontario credit unions and caisses populaires. Deposit insurance is part of a comprehensive depositor protection program that ensures the safety and soundness of credit unions and caisses populaires.

The liability of FSRA to insure deposits held at Ontario credit unions is limited to the assets of the Deposit Insurance Reserve Fund.

To be eligible for deposit insurance coverage, you must be a member of the credit union or caisse populaire. Deposit insurance coverage is provided by the Deposit Insurance Reserve Fund administered by FSRA and pre-funded by Ontario credit unions and caisses populaires at no cost to depositors.

All credit unions and caisses populaires in Ontario are required to prominently display the official decal provided by FSRA at each of their locations.

Common questions

Who pays for deposit insurance coverage?

- Credit unions and caisses populaires pay for deposit insurance coverage through premiums paid to FSRA. All insurable deposits held by depositors are automatically covered.

What happens if a credit union or caisse populaire goes out of business?

- Payments for insurable deposits are made as soon as possible

- The payment includes principal and interest up to $250,000 for insurable deposits held in non-registered accounts aggregated together and unlimited for insurable deposits held in registered accounts

- Borrowers from an insolvent credit union or caisse populaire are responsible for repayment of outstanding debt until paid in full and will be notified by letter from FSRA with specifics, including any exercise of a right of set-off against deposits or deposit insurance payments to assist in such repayment

As an account owner what can I do to ensure complete and prompt payment if my credit union or caisse populaire fails?

- Ensure your credit union or caisse populaire always has your current and complete contact information;

- Understand what’s covered and what’s not.

What’s covered?

Insurable deposits held at Ontario credit unions and caisses populaires in Canadian currency are covered up to a maximum of $250,000. Insurable deposits include:

- Chequing and savings accounts

- Guaranteed Investment Certificates (GIC) and other term deposits (regardless of term of investment)

- Money orders

- Funds in transit

- Index-linked term deposits (principal portion only)

All insurable deposits in the following registered accounts have unlimited coverage:

- Locked-in retirement account (LIRA)

- Life income fund (LIF)

- Registered retirement savings plan (RRSP)

- Registered retirement income fund (RRIF)

- Registered disability savings plan (RDSP)

- Registered education savings plan (RESP)

- Tax-free savings account (TFSA)

What’s not covered?

The following are not covered under FSRA’s deposit insurance program:

- Mutual funds

- Membership shares

- Patronage, investment or preferred shares issued by a credit union

- Foreign currency deposits

- Contents of safety deposit boxes

- Securities held for safekeeping

What is the maximum insurance coverage?

Basic Coverage

The maximum basic coverage for insurable deposits held in non-registered accounts is $250,000 (principal and interest combined) per depositor in each Ontario credit union and caisse populaire and unlimited for insurable deposits held in registered accounts. Deposits held in different branches of the same credit union or caisse populaire are not separately insured.

Separate Coverage

FSRA’s deposit insurance program provides separate coverage for insurable deposits held in joint accounts, trust accounts, registered accounts, and eligible business accounts.

Non-Registered Accounts

Joint Accounts

Deposits held jointly by depositors are insured separately from insurable deposits in each individual depositor’s name, provided the records of the credit union or caisse populaire identify the name and address of each joint owner. The maximum insurance coverage for deposits having the same combination of joint owners at each credit union or caisse populaire is $250,000 (held jointly, not per individual owner).

Trust Accounts

Insurable deposits held in trust accounts are insured separately from deposits owned by the trustee or the beneficiary. Each beneficiary’s portion is insured up to $250,000. Insurable deposits having both the same trustee and the same beneficiary combination are added together and the total is insured to a maximum of $250,000 for each beneficiary.

Registered Accounts

All insurable deposits in registered accounts are all fully insured.

FSRA's Deposit Insurance Program Coverage

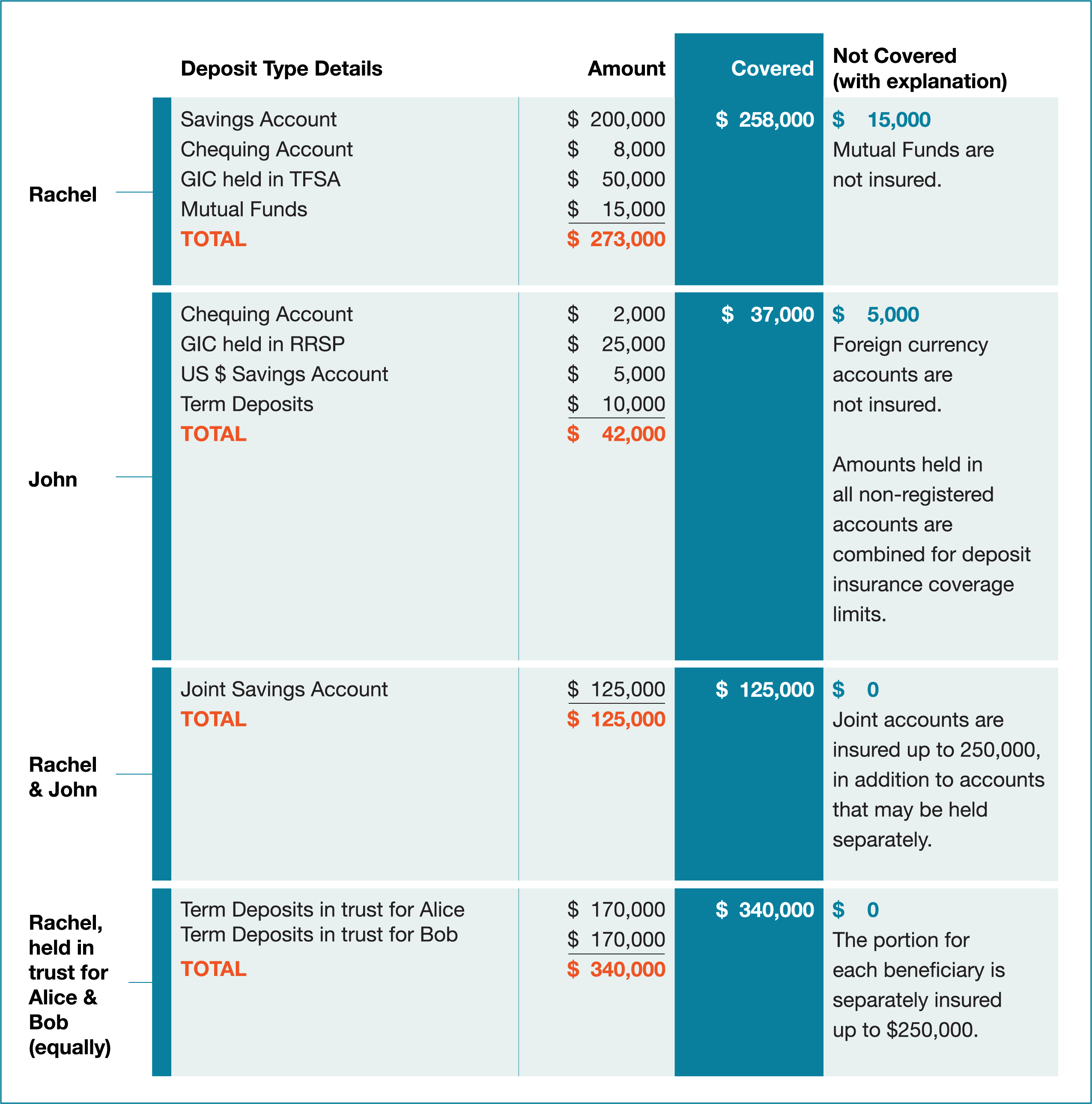

Below is an example showing how FSRA’s deposit insurance program covers insurable deposits for a family.

Note: All amounts include principal and interest payable in Canada (in Canadian dollars)

This webpage contains general information and is not intended to be a legal interpretation of Ontario provincial legislation respecting deposit insurance.

Contact Us

Email us

[email protected]

Call us

416-250-7250

1-800-668-0128

Enforcement and monitoring

We take our responsibilities to protect you from misconduct or non-compliance very seriously. View our most recent enforcement and monitoring information for this sector.

Engagement and consultation

We work with a Consumer Advisory Panel that provides a consumer perspective on proposed FSRA policy changes. View our engagement and consultation information.

Supervision and Administration

We protect the rights of consumers by promoting high standards of business conduct and transparency within the financial services we regulate. View the list of credit unions placed under supervision and administration for this sector.